Calculate how much money you can get back with IRS-Proof mileage logs:

UNEASY ABOUT MILEAGE LOGS?

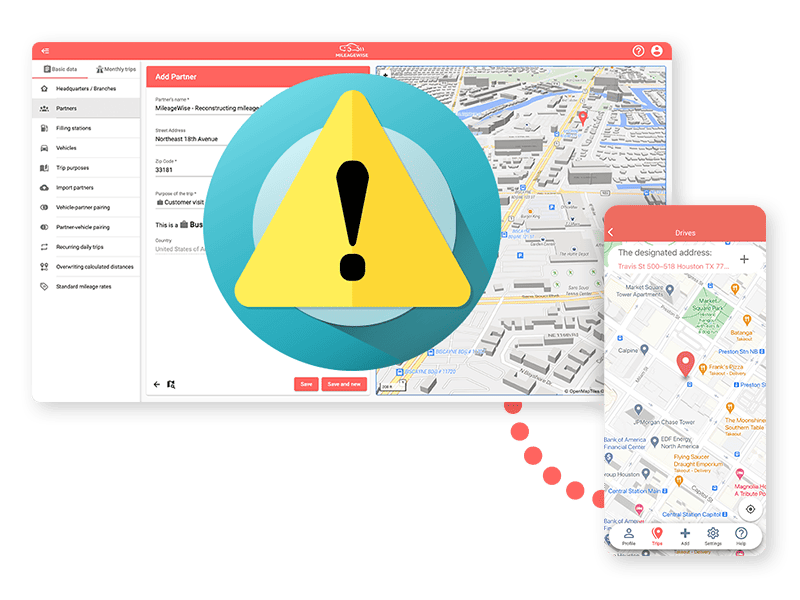

Just found out you needed mileage logs and now you need them fast? Not sure where to start or what tool to use? Maybe you’ve tried an app, Excel file, sample, or template, but you’re not sure the results are complete or IRS-proof.

Want to make sure you’re claiming every possible deduction? Or maybe you already submitted your logs and now realize they need corrections?

OUT WITH THE OLD, IN WITH THE NEW

Using paper logs and other outdated methods can take up to 5 hours a month. And that’s not all.

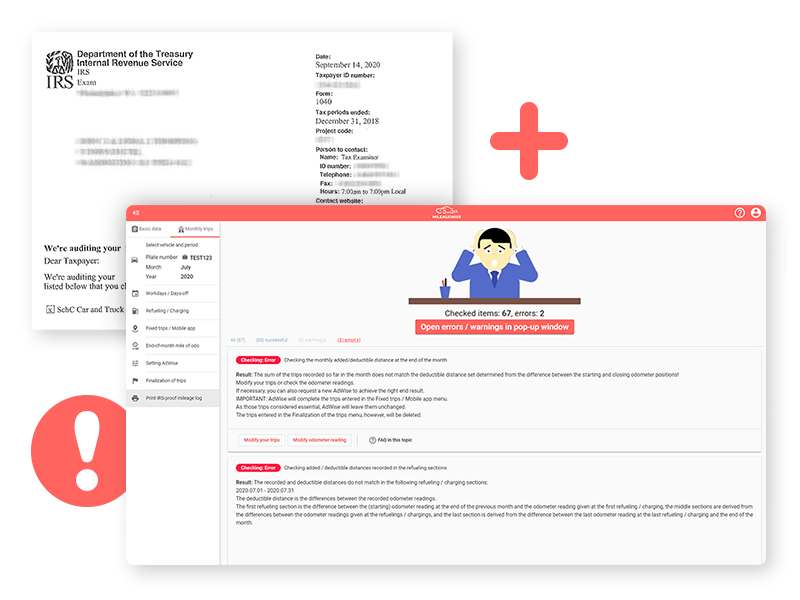

The IRS can request all of your business records, including expense reports, toll receipts, traffic camera data, and more. If those documents don’t match your mileage logs, you could face a hefty IRS fine!

CHOOSE THE WISEST SOLUTION

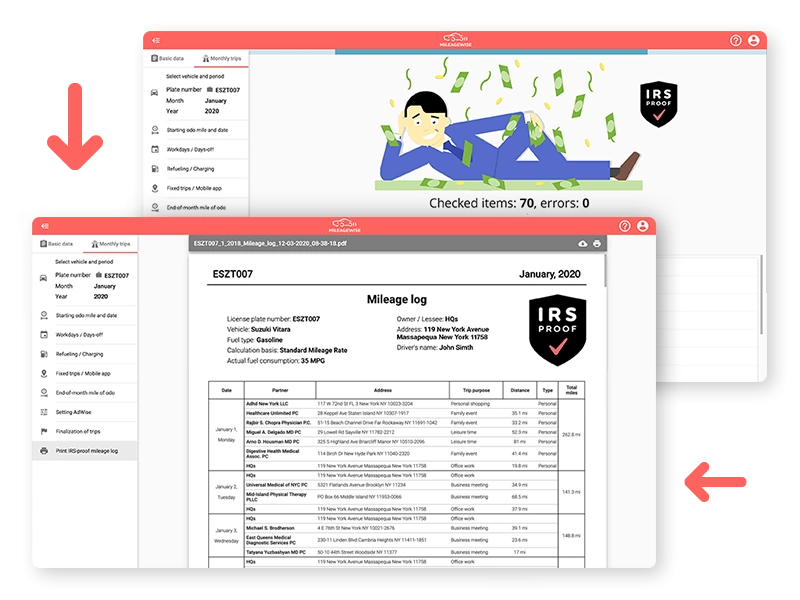

Track your trips with our mileage tracker app, and use the web dashboard for advanced trip management. The built-in IRS auditor will check and correct 70 potential red flags in your log.

Just set a few mileage recovery parameters, and our AI Wizard Mileage Log Generator will fill in the gaps, delivering a 100% IRS-proof result.

"GREAT, BUT SOUNDS EXPENSIVE..."

Take advantage of our 14-day free trial and explore every unique feature we offer. Next to our subscription-based plans, we also offer Lifetime Deals, unlike any other mileage tracker!

When you can create IRS-proof mileage logs in just 7 minutes a month and avoid costly mistakes with a single lifetime investment, it’s easy to see why MileageWise is one of the most affordable mileage tracking solutions out there.