WHAT IF I DIDN'T KEEP TRACK OF MY MILEAGE?

Figuring out how to keep track of mileage for taxes can be tricky, especially if you’ve been relying on a free mileage template or struggling with Excel.

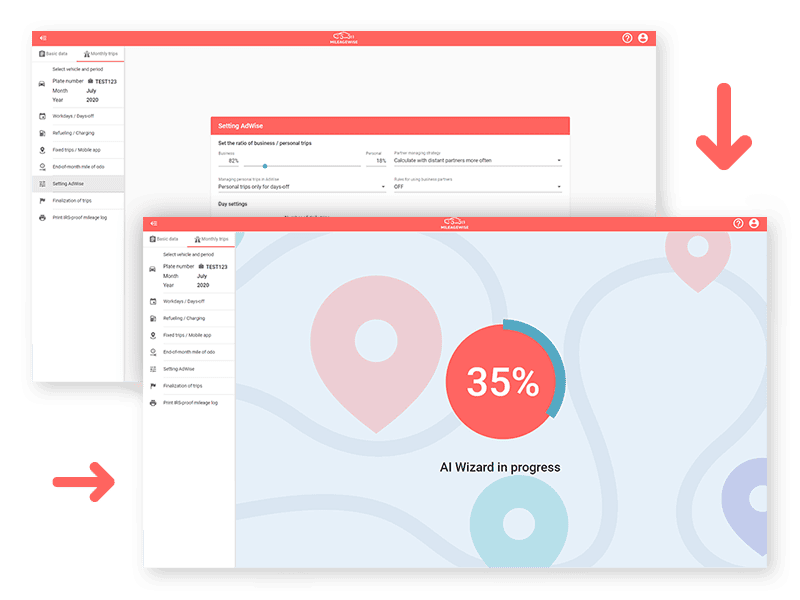

But don’t worry, MileageWise has you covered. Our advanced AI Wizard Mileage Log Generator and Google Maps Timeline import feature topped with our expert Mileage Log Preparation Service can take the load off your shoulders.

WHAT ARE THE IRS PENALTIES OF NOT HAVING A MILEAGE LOG?

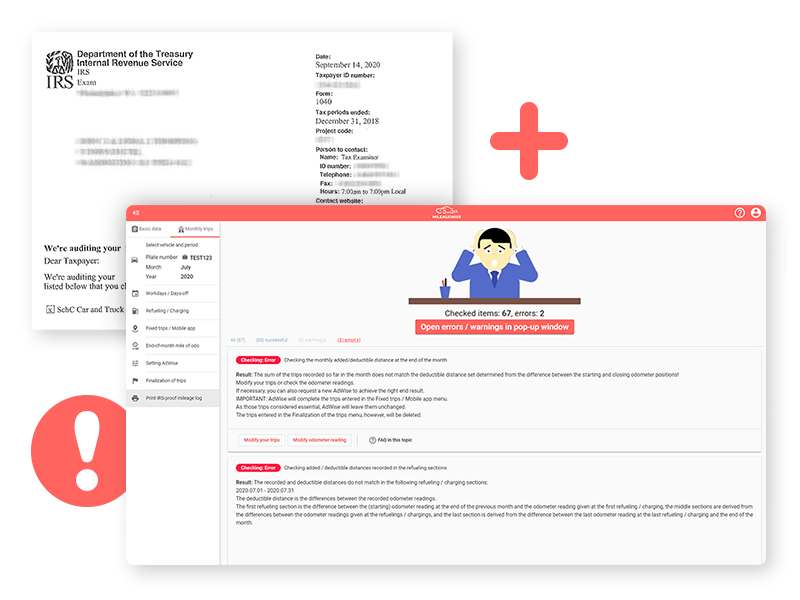

Many people worry about IRS penalties for incomplete or rejected mileage logs. So much so that “mileage log IRS did not accept” is a common Google search. Unfortunately, this concern is completely valid, as a penalty from the IRS can be enormous. Therefore, it’s essential to stay on top of your mileage logs, no matter what.

CLAIMED DEDUCTIONS WITHOUT MILEAGE LOGS?

Have you claimed business mileage deductions without proper records to back them up? Are you wondering how to prove your mileage to the IRS? Hastily assembled logs that don’t show your total mileage can cause serious problems, especially if the IRS comes knocking.

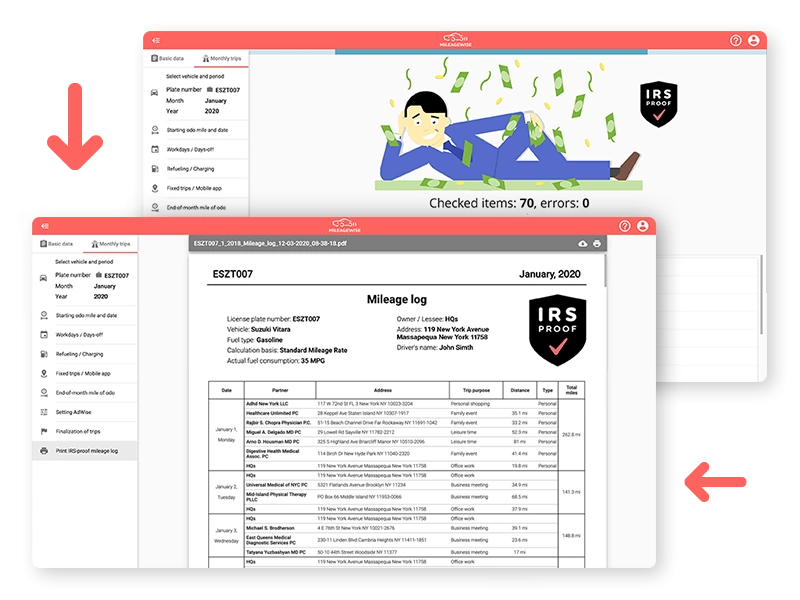

With MileageWise, you can easily reconstruct your past mileage using our Web Dashboard. It’s fast, accurate, and IRS-proof.

Google Timeline Export to Mileage Log

If your Location History was turned on in your Google account, you can export your trips from Google Maps — trips that were automatically recorded in the background. With MileageWise, you can turn those trips into a mileage log in just a few steps.

Paired with our built-in IRS Auditor feature that checks and corrects 70 potential red flags, you can be sure that your logs turn out 100% IRS-proof.

DON'T GIVE UP ON CLAIMING $1,000s

MileageWise retroactively follows all applicable laws and regulations, and with our AI Wizard Mileage Log Generator, you’ll get smart recommendations to fill in any missing trips.

Are you short on time or unsure about your logs? Let our Mileage Log Preparation Service handle it! All we need is some basic info, like your odometer readings and your most frequently visited locations.

“DOES THE IRS APPROVE OF IT?”

As stated in IRS’s Publication 463, documentary evidence recorded retroactively is legally acceptable. And with MileageWise, the process is so easy, you won’t procrastinate or stress about how to track your business miles anymore.

You also won’t have to worry about how to prove your mileage to the IRS — we’ve got you covered. Whether you want to backtrack your mileage logs yourself or have our experts help you, just get in touch.