SherpaShare was a service designed primarily for people who work as independent contractors, particularly those in the ride-sharing and delivery industries, such as drivers for Uber, Lyft, DoorDash, and similar services. Its main purpose was to help these contractors track and optimize their earnings and work-related expenses.

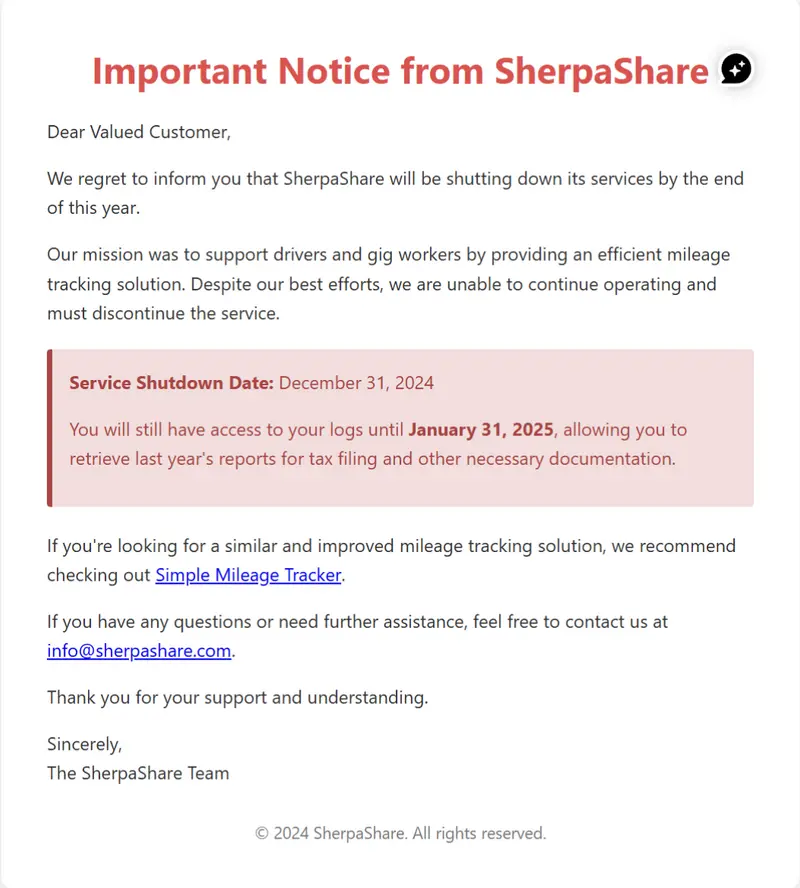

As you’ve probably noiced Sherpashare closed it’s doors so the Sherpasheare App Disappeared from the Android and iOS marketplaces. What are your options now?

Level Up Your Mileage Tracking

MileageWise: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 logical errors in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Try it for free for 14 days. No credit card required!

Too Late For a Sherpashare Review

Sherpashare primarily focused on the gig worker marketplace making it easy to track miles. Right not it is not clear exactly why it closed it’s doors for customers but if you are reading these lines your are looking for a reliable alternative.

On their notice they recommend a mileage tracker but what becomes obvious after you download their recommended mileage tracker that the app hasn’t been updated for 5 years now.

You should now how much sensors GPS communication and data handling changed in our mobile phones in the last 5 years.

Mileage Tracking: As the saying goes “every mile counts”. If your app fails to track one mile that means 70 cents out of your pocket. What you need to maximize is the accuracy of mileage deductions. Simple Mileage Tracker is sadly not built for that by using outdated technology.

What we offer as an alternative is the ability to track your mileage automatically, which is essential for tax purposes. This feature helps you to claim deductions for business-related vehicle use.MileageWise has 3+ tracking options to make your life easier.

When you’re done driving, you don’t need to manually stop the tracker by tapping on the screen. Everything is done for you.

At the end of the day right after you’re done driving, you can review, edit, add or remove trips and export your IRS-proof mileage log.

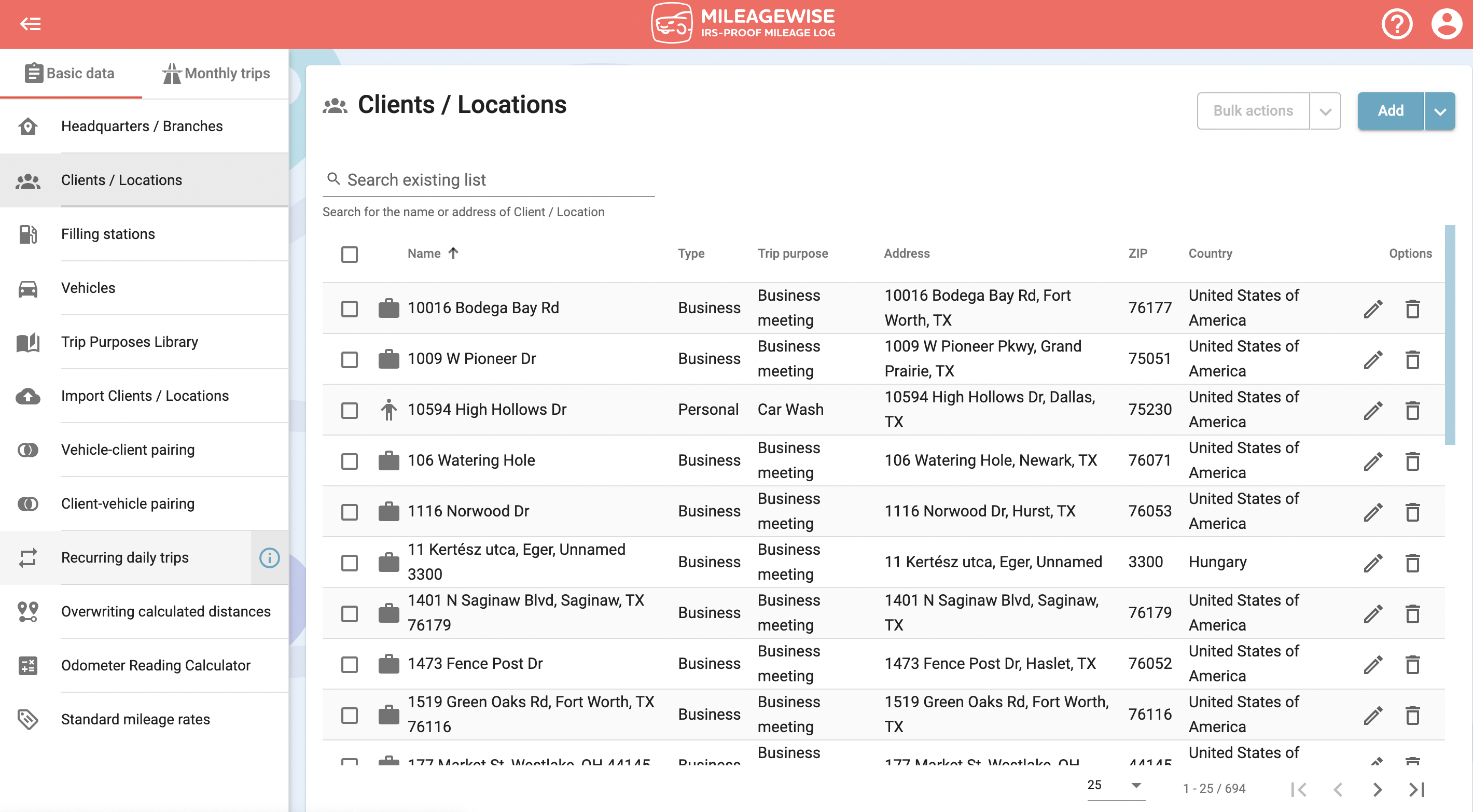

You can also always check and edit your deduction and other important data on the web dashboard:

Trip Classification: as it’s become a trend with other mileage tracker app, SherpaShare also let you swipe to decide if a trip had a business or personal purpose but MileageWise completely automated this process. If you assign purposes for your imported addresses this categorization will happen automatically.

Expense Tracker: you can also keep track of your vehicle-related spending, such as car maintenance, gas, parking, internet and so on:

What Was SherpaShare Pricing?

Let’s take a look at the pricing tiers SherpaShare had to offer:

- Offers a two-week free trial.

- Monthly subscription: $5.99/month.

- Annual subscription: $59.99/year.

- Super Premium: $10/month or $120/year, offering a complete set of driver tool.

How Does MileageWise Compare to SherpaShare?

- MileageWise also has 14-day FREE trial.

- Monthly subscription: $6.99/month

- Annual subscription: $69.99/year

- The only app with lifetime price which is: $119.99

What’s Missing?

Let’s explore now what features were missing from SherpaShare in case you’re looking for a more comprehensive mileage tracker app that doesn’t caters explicitly for rideshare drivers.

Fully Automated Tracking

While we understand that when it comes to rideshare drivers it’s either a personal choice or company decision whether they track each trip separately or log daily summaries, the apparent lack of automatic trip end detection surprised us.

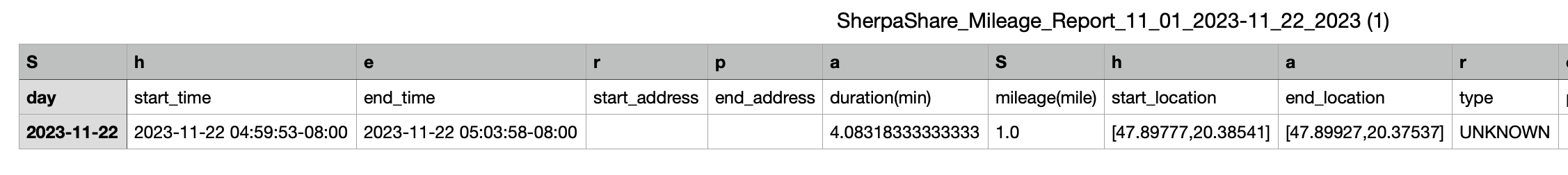

IRS-Proof Mileage Logs

We took a look at the mileage report SherpaShare sends users, so here’s what you get. What surprised us most was that the app didn’t pick up the starting and arrival addresses. Needless to say, records like this won’t stand up against IRS scrutiny.

MileageWise presents a more comprehensive approach to mileage tracking, focusing on compliance and retrospective logging. Let’s take a look at what it has to offer.

Key Features in MileageWise:

- IRS-Proof Mileage Logs: Specializes in producing logs that comply with IRS requirements.

- Retrospective Mileage Logs: MileageWise can create logs for past periods, which is beneficial for audits or forgotten records.

- AI Wizard Technology: Assists in mileage recovery through advanced technology.

- Google Timeline Integration: Imports trips and locations for detailed retrospective logging in case your log has trip gaps.

- Built-In IRS Auditor: Checks for potential red flags and helps to correct them.

- Shared Dashboard for Teams: Facilitates collaborative use, ideal for businesses with fleets.

- Free Phone Support with Live Agent: Ensures accessible assistance.

- In-App Chat: again, it’s super easy to get help if you need.

So What’s the Verdict?

Target Audience: SherpaShare is tailored for rideshare drivers, focusing on maximizing earnings and efficient trip categorization. In contrast, MileageWise caters to a broader audience, including businesses and individuals seeking detailed and IRS-compliant mileage tracking.

Pricing and Accessibility: SherpaShare provided a straightforward pricing structure with a focus on accessibility and ease of use. MileageWise emphasizes compliance and retrospective capabilities, appealing to users who need detailed and compliant mileage records.

Unique Features: SherpaShare was strong because it worked well with rideshare apps. It helped drivers earn more money. MileageWise stands out for its compliance-focused features, AI technology, and ability to create retrospective logs aiming to be the best mileage tracker app by recovering lost mileage data.

Both apps have unique features. The choice between them depends on what the user needs. A rideshare driver may focus on earnings. A business or user may need detailed logs that meet IRS rules. No one knows exactly when Sherpashare ceased to exist. What matters, though, is that every rideshare driver needs to track every mile for tax season.