Last updated: March 19, 2025

In the gig economy, flexibility and independence are key attractions. However, for Walmart Spark delivery drivers, this freedom brings the added responsibility of managing personal finances, particularly understanding and handling taxes effectively. This guide delves deep into the tax obligations and benefits for Spark drivers and introduces the vital role of effective tools like MileageWise. In addition, it offers practical advice to maximize your financial benefits.

Try it for free for 14 days. No credit card required!

Dashboard

What Are the Tax Responsibilities for Spark Delivery Drivers?

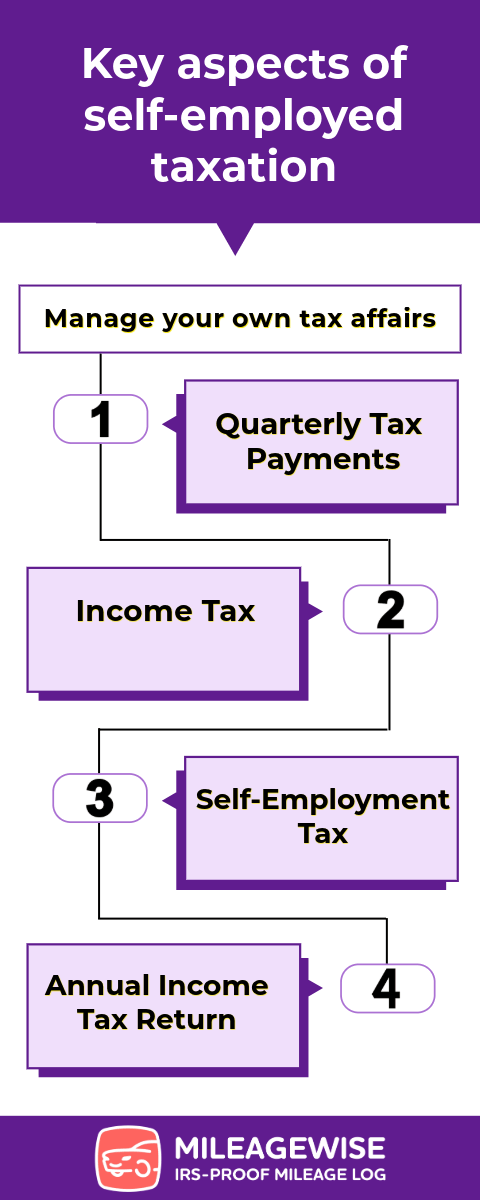

As a Spark delivery driver, you are classified as an independent contractor, which significantly impacts your financial and tax responsibilities. Unlike traditional employees, who have taxes withheld from their paychecks by their employers, you are required to manage your own tax affairs. This involves several key aspects of self-employed taxation:

Quarterly Tax Payments

Since your income isn’t subject to automatic withholding, the IRS requires you to make estimated tax payments quarterly. These payments cover your income tax and self-employment tax obligations for the year. Making these payments helps you manage your cash flow better and avoids large lump-sum payments at tax time.

Income Tax

The income tax you owe as an independent contractor is based on your adjusted gross income. This includes all your earnings minus allowable deductions and exemptions. Since your tax rate depends on your total income, it’s crucial to accurately report all earnings and understand which deductions you can claim to reduce your taxable income.

Self-Employment Tax

In addition to income tax, independent contractors must pay self-employment tax, which covers your contributions to Social Security and Medicare. The self-employment tax rate consists of Social Security and Medicare payments. This tax is calculated on your net earnings from self-employment, and it’s essential to include this in your quarterly tax payments to avoid penalties.

Annual Income Tax Return

Additionally, you must file an income tax return with the IRS using Form 1040 each year. Along with this form, you’ll attach Schedule C, which is used to report the income you’ve earned as a Spark driver. This form helps you calculate your net business income after deductions, which forms the basis for your income tax and self-employment tax.

Understanding these elements of self-employed taxation ensures you meet your tax obligations as a Spark driver, avoid potential penalties, and possibly reduce the amount of tax you owe through strategic deductions and credits.

What Tax Deductions am I eligible for?

Understanding and utilizing tax deductions can significantly reduce your taxable income, potentially saving you a considerable amount of money each year. For Spark delivery drivers, various expenses directly related to their driving activities can be deducted from their taxes. Here’s a deeper look at some of the specific deductions you might be eligible for:

Mobile Phone and Data Plans

Since a smartphone is essential for managing your delivery routes and communicating with customers and the Spark platform, a portion of your phone bill and data plan can be deducted. The key here is only to deduct the percentage of time the device is used for work-related activities.

Health Insurance Premiums

If you’re self-employed and responsible for your own health insurance coverage, you may be able to deduct premiums paid for medical, dental, and some long-term care insurance. This deduction is taken on your Form 1040 and can reduce your adjusted gross income.

Meals

While on the road, you might need to purchase meals. A portion of these expenses can be deductible if the meals are consumed during a business operation. Note that after the Tax Cuts and Jobs Act, only 50% of these expenses are generally deductible.

Supplies and Accessories

Any supplies you purchase directly for use in your delivery work can be deductible. This includes things like maps, flashlights, batteries, car chargers, or even more substantial items like a car-top carrier or specialized equipment for handling your deliveries.

Parking and Tolls

Moreover, fees for parking and tolls paid while on delivery jobs can be fully deductible. However, parking tickets and fines are not deductible.

Vehicle Expenses

This is one of the largest categories of deductions for delivery drivers. You have two choices here—either deduct actual vehicle expenses or use the standard mileage rate. Actual expenses include gas, oil, repairs, tires, insurance, depreciation, and lease payments. Alternatively, the standard mileage rate simplifies record-keeping by allowing you to deduct a set amount for each business mile driven, as specified by the IRS each year.

Note, that accurate record-keeping of your expenses and miles is crucial as it provides evidence for your claims in case of an IRS audit. Utilizing these deductions effectively can lead to substantial savings in your tax liabilities, enhancing your overall financial success as a Walmart Spark delivery driver.

What is the 1099 form I have received form Walmart?

As a Walmart Spark driver, you will receive a Form 1099 from Walmart, which details the income you earned over the year without any tax withholdings. This form is essential for accurately reporting your income to the IRS and ensures you’re not overpaying or underpaying your Spark delivery tax dues.

The Power of Mileage Deduction for Delivery Drivers

Mileage tax deduction offers a straightforward way to reduce delivery drivers’ tax burden. The IRS allows a set deduction amount per business mile driven, which simplifies record-keeping and calculation. Keeping an accurate and IRS-compliant mileage log for your Spark driver gig is crucial to take advantage of this deduction.

How Can I Keep a Compliant Mileage Log?

Maintaining an IRS-compliant mileage log requires diligent record-keeping. Whether you opt for a manual method like a notebook, or a Google / Excel spreadsheet, or opt to use a specialized app, the key is to accurately capture every business-related drive. Consistent and regular entries in your mileage log for your delivery driving business are crucial, as they provide more precise records and save you from the rush of retrospectively creating your logs during tax time.

The choice between paper logs, digital spreadsheets, and sophisticated apps depends on your personal preference, comfort with technology, and daily routine. Paper logs and spreadsheet templates, while simple, require manual updates. On the other hand, software and apps offer more convenience and accuracy, especially with features designed to simplify the process.

MileageWise: The Optimal Mileage Tracking Solution for Spark Drivers

MileageWise stands out as a mileage tracking solution specifically designed for delivery drivers. Its features automate the tracking process, ensuring your mileage logs are precise and compliant with IRS regulations. Using MileageWise can transform your tax preparation efforts, making them more streamlined and less prone to error.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Best features of the MileageWise mileage tracking app for delivery drivers:

Standby Timer feature

Unlike other mileage tracking apps, MileageWise does not follow every move of your vehicle but records arrivals and calculates distances in the background. Therefore, it uses less battery and complies with privacy regulations. To ensure the automatic tracker doesn’t log every stop (for example at a red light) as a destination, you have to spend a certain time at a location for the app to record it as an arrival.

The standby timer setting allows you to tailor this timeframe to your specific needs, which is crucial for delivery drivers. Just set the timer based on how long you’re idle at each location before you depart on your next delivery.

Built-in IRS Auditor

MileageWise includes a built-in IRS Auditor that rigorously examines mileage logs to ensure they adhere to IRS standards. This feature identifies up to 70 potential red flags in historical logs and offers corrections to mitigate risks during tax audits.

Automatic Trip Categorization

This functionality enables users to effortlessly classify trips as business or personal based on predefined rules. The Auto-Classification feature streamlines the documentation process and ensures accurate reporting for taxation or reimbursement purposes.

Retrospective Mileage Log Generation

For users who have not kept real-time mileage records, this function allows the creation of past logs using historical data and patterns, such as those found in Excel spreadsheets or Google Timeline, aiding in the accurate reconstruction of logs.

AI Wizard Mileage Log Generator

Our AI-powered Mileage Log Generator improves mileage logs by recommending the most advantageous trips and settings, drawing from a user’s historical driving patterns and data. This tool not only increases tax deductions but also aids in precisely reconstructing past trips to match odometer records and claimed tax deductions.

FAQs

Are Spark Drivers Walmart Employees?

No, Spark drivers are not Walmart employees. They are independent contractors who partner with Walmart’s Spark delivery program. This means they operate on a freelance basis, managing their own schedules and using their own vehicles for deliveries.

Can Spark Drivers Claim Mileage on Taxes?

Yes, Spark drivers can claim mileage on their taxes. As independent contractors, they are eligible to deduct business-related mileage expenses. This can be done using the standard mileage rate set by the IRS, which compensates for each mile driven for business purposes.

What happens if I don’t keep a detailed mileage log?

Failing to maintain a detailed mileage log can lead to complications if you are audited by the IRS. Without proper documentation, you may be unable to substantiate your claimed mileage deductions, which could result in penalties and the need to pay additional taxes.

How do I handle taxes if I drive for multiple gig platforms, not just Spark?

If you drive for multiple gig platforms, you must report all your earnings from these services on your tax return. You can also consolidate expenses related to your driving business, such as vehicle maintenance and fuel costs, regardless of which platform you were driving for at the time. It’s crucial to keep detailed records for all your gigs to accurately report income and claim deductions across different platforms.

How does MileageWise ensure the accuracy of my mileage logs?

MileageWise employs advanced features to ensure the accuracy and IRS compliance of your mileage logs. The app includes automatic trip detection, and tools for retrospective log creation based on historical data. Additionally, MileageWise’s built-in IRS Auditor checks your logs against up to 70 potential red flags, suggesting corrections to guarantee compliance and maximize your deductions.

This level of scrutiny and support helps ensure that every mile you log is accurately recorded and defended if audited.

Conclusion

Understanding and effectively managing your taxes as a self-employed Spark delivery driver is essential, not just for legal compliance but also for maximizing your earnings. With tools like MileageWise, you can simplify the tax handling process, ensure accuracy, and minimize the time spent on paperwork, allowing you to focus more on your deliveries.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Rebeka Barefield

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |