CLIENT TROUBLES?

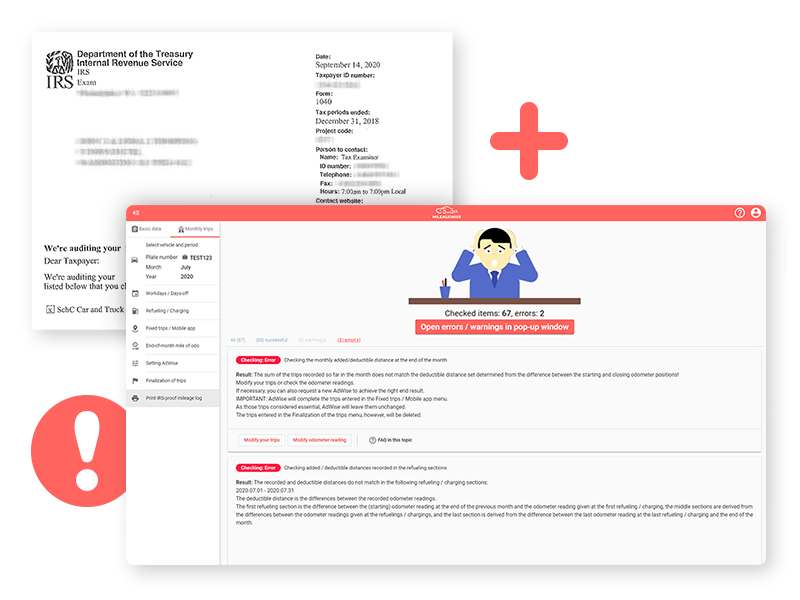

Does piecing together your clients’ mileage logs feel like a nightmare? Reconstructing trips from random documents, especially during an IRS audit or after a rejected mileage log, can feel almost impossible.

And on top of that, you’re stuck trying to meet unrealistic expectations, like claiming sky-high deductions without proper records to back them up.

DOABLE, BUT AT WHAT COST?

Keeping your clients’ mileage logs on paper or with traditional mileage logging software/Excel sheets/templates/samples can take up a tremendous amount of your time for a task that your clients often consider a self-evident part of your job. No extra compensation.

Not to mention, working based on information received from another person always holds the possibility of errors and an IRS audit.

TEAMWORK MAKES THE DREAM WORK

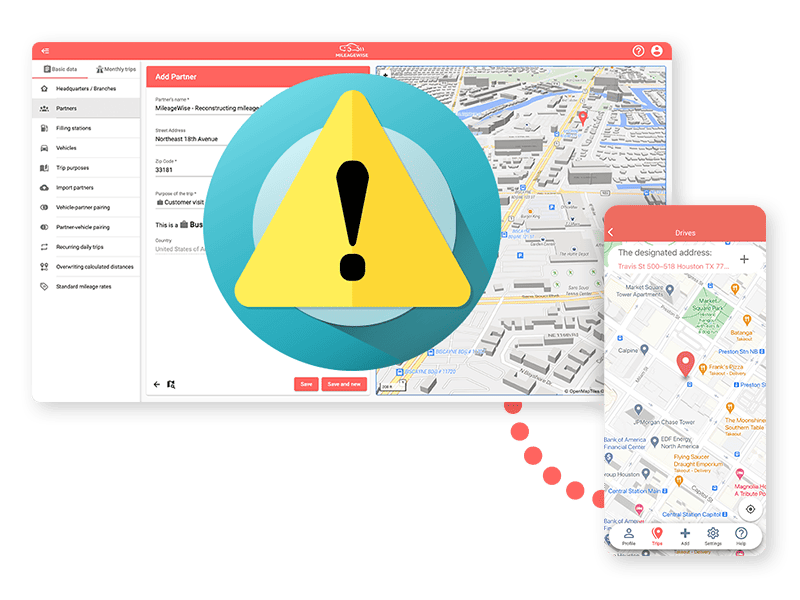

Your clients can track their trips on the go with our Mileage Tracker App or use our Web Dashboard, which they can share directly with you. This way, you can follow, review, and generate their mileage log — no more chasing down missing documents.

Need to rebuild past logs? Our AI-powered Mileage Log Generator helps you reconstruct their trips, so you can support retrospective mileage claims with ease.

MILEAGEWISE FOR PEACE OF MIND

We designed MileageWise to deliver IRS-proof results and a stress-free mileage logging experience. The built-in IRS auditor automatically checks and corrects 70 potential red flags before finalizing your mileage log.

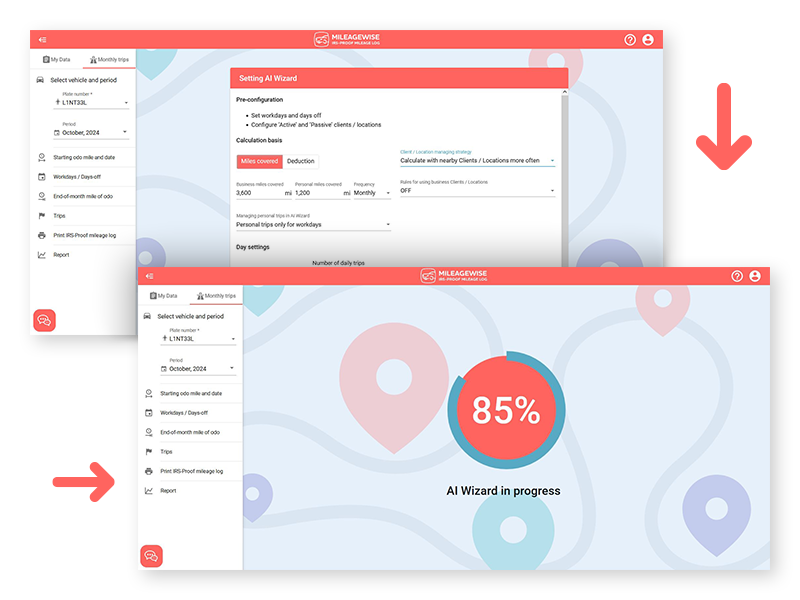

Furthermore, the AI Wizard Mileage Log Generator will give you recommendations for your missing trips. Just set a few details and MileageWise will fill in the gaps in your IRS-Proof mileage logs quickly.

TOO MANY CLIENTS, TOO LITTLE TIME?

If you have too many clients and not enough time to handle their mileage logs, outsource the entire task to the MileageWise team. Our experts will prepare both ongoing and retrospective IRS-proof mileage logs and deliver them to you. That means less stress and more time for other important tasks.