Last Updated: February 3rd, 2025

In today’s rapidly evolving world of electric vehicles (EVs), understanding how to properly reimburse mileage is crucial for both employees and employers.

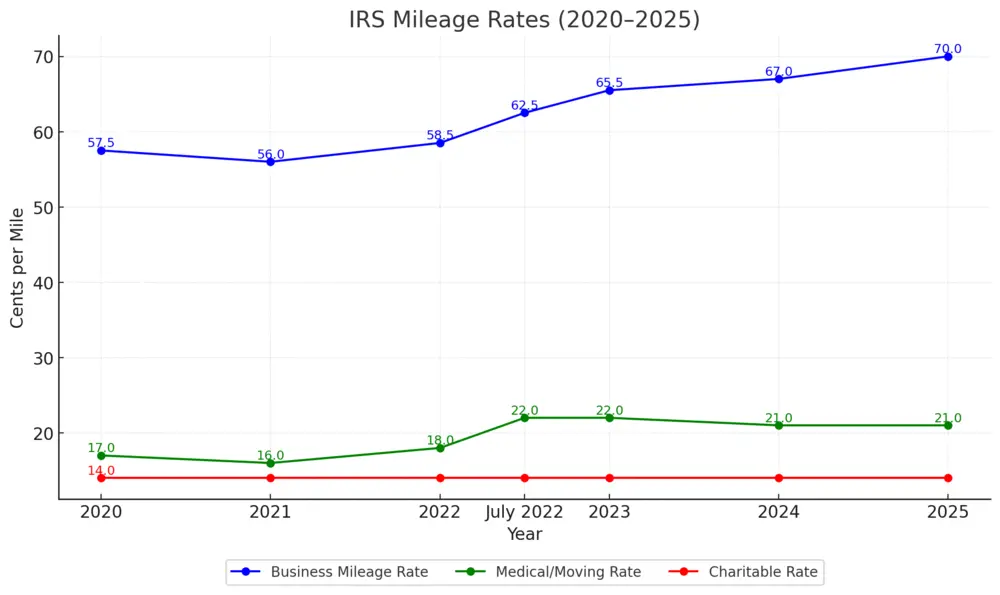

The 2025 IRS standard mileage reimbursement rate for electric vehicles (EVs) in the United States is 70 cents per mile for business use, the same rate applied to gas-powered vehicles. This rate accounts for all vehicle-related expenses, including electricity, maintenance, and depreciation. Read on for a detailed breakdown.

Level Up Your Electric Car Mileage Reimbursement

MileageWise: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 potential red flags in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Try it for free for 14 days. No credit card required!

Table of Contents

The Basics of EV Reimbursement

Electric vehicle mileage reimbursement rate covers the costs incurred by employees when using their EVs for work-related travel. Like gas-powered vehicle reimbursements, EV mileage compensation aims to cover the expenses of operating the vehicle. However, the costs involved differ, which is why understanding the specifics of electric car mileage reimbursement rates is so important.

Differences from Traditional Gas Vehicle Reimbursement

The reimbursement rate for electric vehicles differs from that of traditional gas-powered cars due to factors such as energy costs and depreciation. While gas prices fluctuate, electricity costs are often more stable. Furthermore, the wear and tear on EVs and the overall maintenance required are different from gas vehicles, leading to unique reimbursement needs.

Current IRS Standard Mileage Reimbursement Rates for Electric Cars

While the IRS provides a standard mileage rate, it currently doesn’t distinguish between electric and gas-powered vehicles. However, businesses and employees using electric cars should be aware of the distinct costs involved when calculating reimbursement, ensuring they receive fair compensation based on their vehicle’s actual expenses.

Here is How Much You Could Save Using The Sandard Mileage Rate

Factors Affecting Electric Car Mileage Reimbursement Rate

Energy Costs and Efficiency

Electric cars are generally more energy-efficient than gas-powered vehicles. The cost of charging your car, whether at home or at public stations, directly affects the reimbursement rate. Charging prices depend on location and electricity rates, making it important to track these costs closely.

Depreciation Considerations

Just like traditional vehicles, electric cars depreciate over time. However, EVs often have a different depreciation curve due to factors like battery life. Depreciation is an important factor in setting a fair electric car reimbursement rate.

Maintenance and Repair Expenses

Electric vehicles have fewer moving parts than gas-powered cars. That means lower maintenance and repair costs. This difference should be considered when determining a fair reimbursement for EVs.

Perks of Getting and Electric Car For Business Purposes

Tax Credit for Purchasing an Electric Vehicle

If you purchase a plug-in electric car (such as a Tesla) you may qualify for a tax credit. An electric tax credit by the government was introduced in 2008 to spur the electric-car industry. For every new electric vehicle purchased by taxpayers, the government offers a non-refundable tax credit of 7.500. You can claim the electric vehicle tax credit using IRS Form 8936.

You get a credit of at least $2,500 for electric vehicles purchased after December 31, 2009. The tax credit can increase up to $7,500 depending on the following:

- The kilowatt capacity

- The number of electric vehicles the manufacturer sold

You can get an additional $417 for each kilowatt-hour of battery capacity in excess of 5-kilowatt hours.

State-offered incentives

Many states also offer incentives for purchasing an electric car. This can include tax credits, the right to carpool lanes, and more. On the website of the Department of Energy, you can find out which country legal guidelines may also apply to you.

Mileage allowance for electric cars

According to PlugInAmerica.org, “in order to equal the price of the average gasoline car’s fuel costs, the price of electricity would have to be 2.5 times the national average, and cost 31 cents per kWh.”

If you drive an electric car and your company has a reimbursement plan, you should stick to these numbers when negotiating your allowance. This also means that electric car drivers are paying less for miles in general. 😉

Cheaper fees

Fees may be even cheaper all through off-peak times. The PEV resource center reports that “off-peak electricity rates of about $0.10 per kilowatt-hour (kWh) is the equivalent of driving on gasoline that costs less than $1 per gallon.”

Tax deduction on your business mileage

According to the IRS, depending on the type of your business you can deduct your business-related expenses. Such as travel and transportation.

By keeping sufficient documentary evidence of your expenses you can write off all of the following: depreciation, lease payments, registration, garage rent, licenses, repairs, gas, oil, tires, insurance, parking fees, and tolls.

However, you need to prove that these expenses are actual business expenses. Therefore, you need a mileage log for your business mileage tax deduction.

Track 1000+ trips/month and refuelings on the go with the MileageWise mileage tracker app. Or you can use your car’s built-in GPS system (with an app for data retrieval) and perfect them on the web dashboard!

If your car (eg. Tesla, Audi, Volvo) already has an app that creates a base for mileage logs, you can import those documents and edit them quickly and easily in MileageWise!

The Built-In IRS Auditor checks and corrects 70 potential red flags with our smart algorithm, so your recommended mileage log will be IRS-proof and meet the expectations, without a doubt.

With these innovative developments, mileage logging is easy. There’s no need to worry about running the administration anymore. 🙂

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

FAQ

The mileage reimbursement rate for electric vehicles (EVs) can vary based on several factors, including the year, the IRS guidelines, and specific company policies. As of 2024, the IRS standard mileage rate for business use typically reflects the operating costs of all vehicle types, including electric and gas-powered vehicles. It’s crucial to check the latest rates published by the IRS and your company’s policies to determine the exact reimbursement rate applicable to your situation.

To calculate mileage for electric vehicles, you need to track the total number of miles driven for business purposes. This can be done using a mileage tracking app or by maintaining mileage logs. Multiply the total business miles driven by the current mileage reimbursement rate to determine your total reimbursement amount for mileage claims. Additionally, for electric vehicles, you may also want to keep track of the kwh used, as some companies offer additional reimbursements based on fuel consumption.

Yes, there can be differences in mileage reimbursement rates between electric vehicles and traditional gas-powered vehicles. While the IRS standard mileage rate applies to all vehicle types, some companies may offer higher rates for electric vehicles to encourage their use and account for the lower operating costs. Always check with your employer’s reimbursement policies for specific rates.

The standard IRS mileage reimbursement rate for 2024 is set annually and can change based on various economic factors, including fuel prices and vehicle maintenance costs since the rate is designed to encompass these factors. For the most accurate and up-to-date information, refer to the IRS website or consult with a tax professional who can provide insights into the current mileage reimbursement rates applicable for both electric and traditional vehicles.

The IRS sets the standard mileage rate annually, which serves as a guideline for businesses and individuals claiming mileage reimbursement. For 2024, the reimbursement rate for electric vehicles is expected to reflect the increasing costs of electricity and maintenance. It’s important to check the IRS website for the most up-to-date figures, as they can change based on various economic factors.

Tracking electric car mileage can be done manually using a mileage log, or through a mileage tracking app. These apps automatically record your trips, allowing you to categorize them as business or personal. Keeping detailed records of your business mileage is essential for accurately calculating mileage reimbursement and ensuring you maximize your potential tax deductions.

Using an electric vehicle for business can provide several benefits, including lower fuel costs and fewer emissions compared to traditional gas-powered vehicles although the range may be limited. Additionally, businesses may benefit from government incentives for using electric cars, which can further enhance the financial viability of incorporating electric vehicles into their operations.

Yes, self-employed individuals can claim mileage reimbursement for their electric vehicles. The IRS allows self-employed individuals to use either the standard mileage rate or actual expenses incurred while operating the vehicle.

The mileage reimbursement rate for electric vehicles in 2024 is based on the IRS standard mileage rate, which is updated annually. For 2024, the rate will likely be adjusted to reflect increases in the costs associated with operating a car. Typically, the rate considers factors such as the cost of electricity in kwh, maintenance, and depreciation. Businesses and self-employed individuals must stay updated on these rates to ensure accurate mileage reimbursement claims.

To calculate mileage reimbursement for your electric vehicle, you need to track the total number of miles driven for business purposes. Use a mileage tracking app or maintain mileage logs to record your trips. Once you have the total business mileage, multiply it by the current IRS mileage rate for electric vehicles. This will give you the total reimbursement amount, which can be claimed on your taxes as a business mileage reimbursement.

The benefits of mileage reimbursement for electric vehicles include financial relief for the costs associated with operating an EV for business use. This can cover the cost of charging, maintenance, and other expenses related to the use of electric vehicles. Additionally, claiming these reimbursements can significantly lower your overall tax burden, helping you maximize your tax deductions. Moreover, it encourages the adoption of cleaner technologies like electric cars.

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |