Managing payroll is a big challenge for small business owners. It involves many rules, taxes, and employee needs. We will look at what is the best payroll program for small businesses and give you tips to choose wisely.

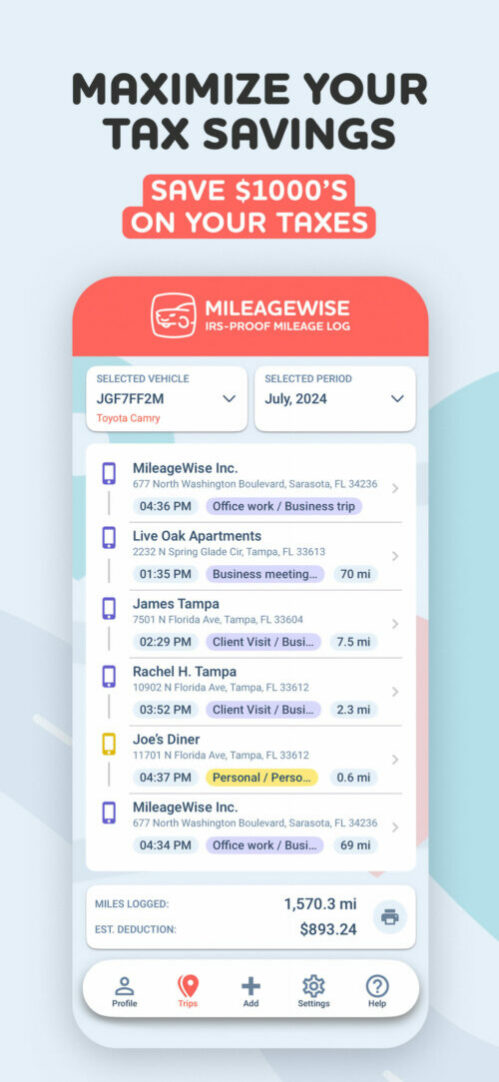

Level Up Your Mileage Tracking

MileageWise: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 logical errors in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Try it for free for 14 days. No credit card required!

Why Is Payroll Software Important for Small Businesses?

Payroll software makes paying employees easier. It handles taxes and follows rules. Here’s why it’s key:

- Time-Saving: It automates tasks, saving you time.

- Accuracy: It cuts down on mistakes in payroll.

- Compliance: It helps follow federal and state laws.

- Employee Satisfaction: It ensures employees get paid right and on time.

Key Features to Look for in Payroll Software

When looking for the best payroll program for small businesses, consider these features:

- User-Friendly Interface: It should be easy to use, even for those not tech-savvy.

- Automatic Tax Calculations: Look for programs that handle federal, state, and local taxes automatically.

- Direct Deposit: Choose software that supports direct deposit for easier employee payments.

- Time Tracking: Integrated time-tracking features can improve the payroll process.

- Reporting Capabilities: Find software with customizable reporting tools for better insights.

- Customer Support: Reliable support is key for solving payroll issues.

Top Payroll Programs for Small Businesses

Now, let’s look at some top payroll programs for small businesses. Here are our favorites:

1. Gusto

Gusto is a top pick for small businesses. It has a user-friendly interface and offers:

- Automatic payroll processing

- Benefits administration

- Integrated time tracking

- Affordable pricing plans

Gusto is great for small businesses needing a full payroll and HR solution.

2. QuickBooks Payroll

QuickBooks Payroll is a favorite for its integration with QuickBooks. It includes:

- Seamless integration with QuickBooks

- Automated tax calculations and filings

- Direct deposit features

- Employee self-service options

If you use QuickBooks for accounting, this payroll solution is perfect for you.

3. Paychex

Paychex offers a robust payroll solution for all business sizes. It has:

- Flexible payroll processing options

- Comprehensive HR services

- Mobile app for payroll management

- Dedicated customer support

Paychex is great for small businesses needing a wide range of services.

4. OnPay

OnPay is known for its simplicity and affordability. It offers:

- Flat-rate pricing structure

- Unlimited payroll runs

- Automatic tax calculations

- Employee benefits management

OnPay is perfect for small businesses looking for budget-friendly options.

5. Square Payroll

Square Payroll is great for businesses using Square for payments. It has:

- Simple setup and management

- Integrated payment processing

- Direct deposit and pay cards

- Tax filing services

Square Payroll is ideal for small retail and service businesses.

How to Choose the Right Payroll Program

Choosing the best payroll program for your small business depends on several factors:

- Business Size: Consider the number of employees you have and whether the software can scale with your growth.

- Budget: Evaluate pricing models and choose a program that fits your financial plan.

- Features Needed: Identify the specific features you require, such as time tracking or benefits administration.

- Integration: Ensure the software can integrate with your existing systems, such as accounting software.

Conclusion

Finding the best payroll program for small businesses can greatly simplify your payroll processes. It also helps maintain compliance with tax regulations. Gusto, QuickBooks Payroll, Paychex, OnPay, and Square Payroll are all excellent options to consider.

By assessing your business needs and budget, you can choose the right payroll solution. Investing in a good payroll program saves you time and cuts down on mistakes. It also improves employee satisfaction.

Recommended reading:

What is the Best Payroll Company for Small Business?

What Is Really The Best Mileage Tracker App?

What Do FREE Mileage Tracker Apps Actually Offer?